Unlock Your Real Estate Potential with Verified Investors

Connect with Local, Trusted Private Lenders to Fund Your Next Project

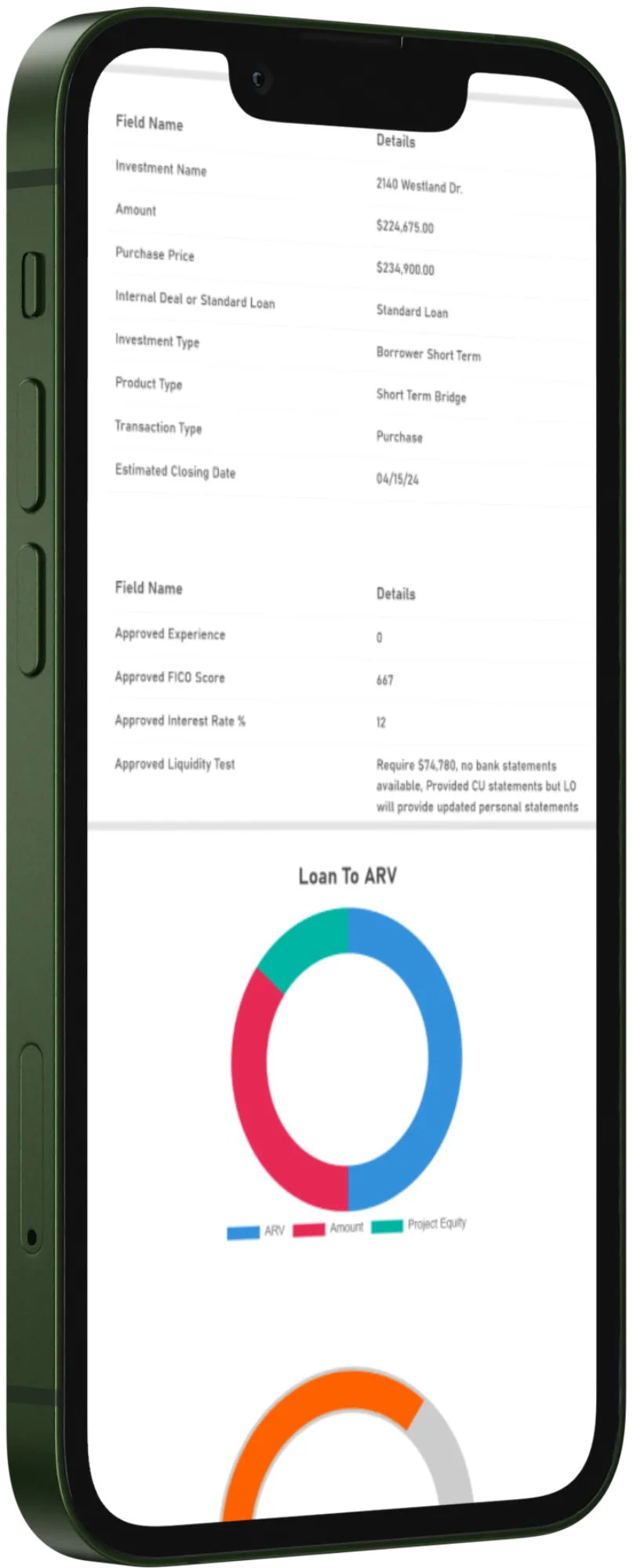

At Verified Investor, we understand the challenges real estate investors face when seeking capital for their projects. Traditional banks often have strict requirements, slow approval processes, and little flexibility. That's why we've created a platform that connects you with a network of verified, experienced private lenders who are ready to invest in your success.

The Power of Verified Investors:

Our rigorous vetting process ensures that every Verified Investor on our platform has the expertise, capital, and commitment to help you bring your real estate vision to life. When you work with a Verified Investor, you gain access to:

Quick Closings:

Get the funding you need in as little as 10-14 business days, so you can seize opportunities as they arise.

Flexible Terms:

Our lenders understand the unique needs of real estate investors and are willing to structure deals that work for you.

Local Expertise:

Connect with lenders who know your market and can provide valuable insights to help your project succeed.

A Wide Range of Loan Options:

Whether you're looking to fix and flip, refinance a rental property, or embark on a ground-up construction project,

our Verified Investors have the resources to support your goals.

Whether you're looking to fix and flip, refinance a rental property, or embark on a ground-up construction project, our Verified Investors have the resources to support your goals.

We Offer:

Fix and Flip

Loans

30-Year Rental

Property Refinancing

Ground-Up Construction Loans

Many Other Business Purpose Loans

Empowering Investors Like You:

At Verified Investor, we believe in the power of real estate investing to create wealth and transform communities. That's why we're committed to supporting investors like you with the capital and resources you need to succeed. When you partner with a Verified Investor, you can:

Focus on Your Project:

Spend less time worrying about financing and more time bringing your vision to life,

Grow Your Portfolio:

With reliable access to capital, you can scale your investments and achieve your long-term goals.

Make a Difference:

By revitalizing properties and developing new projects, you're helping to strengthen local communities.

Get Started Today:

Ready to take your real estate investing to the next level?

Connect with a Verified Investor today and discover the difference that reliable, flexible capital can make for your projects.

Not a Real Estate Investor? Become a Verified Investor:

If you're an experienced private lender looking to connect with qualified real estate investors, we invite you to join our network. As a Verified Investor, you'll gain access to a steady stream of vetted investment opportunities and the support of our thriving community.

Trust the Verified Investor Difference:

When you choose Verified Investor, you're partnering with a platform dedicated to your success. We've built a reputation for transparency, integrity, and results, and we're committed to helping you achieve your real estate investing goals.

Take the

First Step:

Don't let financing hold you back from achieving your real estate dreams.

Connect with a Verified Investor today and unlock the power of flexible, reliable capital.

Privacy Policy | Terms And Conditions

2024 Copyright - Verified Investor

Disclaimer: A verified investor, as described here, is a real estate investor actively involved in purchasing real estate assets, including but not limited to mortgages or properties. It's important to note that a verified investor is distinct from an accredited investor, who meets specific criteria such as income, net worth, or professional experience, as defined by securities laws and regulations. The term 'verified investor' pertains specifically to real estate investing and should not be confused with the accreditation status required for certain investment opportunities.

Verified Investor is not a law firm or a registered investment advisor, and it does not provide legal or investment advice

Facebook

Instagram

X

LinkedIn